Benford’s Law: A Powerful Forensic Tool for Detecting Financial Fraud and Embezzlement

Benford’s Analysis: A Forensic Tool for Detecting Fraud

Fraud isn’t always about missing money—it’s about numbers that don’t add up. Most fraudsters don’t realize that when they manipulate financial records, they leave behind patterns that stand out to anyone who knows where to look. They might think they’re covering their tracks, but the numbers tell a different story.

Benford’s Analysis is one of the sharpest tools for spotting these hidden red flags. It’s based on a simple but powerful truth: in naturally occurring data, numbers follow predictable patterns. When they don’t, there’s often a reason—one worth investigating.

But here’s the catch: Benford’s Law doesn’t prove fraud on its own. It points investigators in the right direction, showing them where to dig deeper. Used correctly, it can uncover everything from embezzlement to cooked books. Used incorrectly, it can lead to wild accusations and wasted time.

So how does it work? And why do so many fraudsters get caught by it without even knowing? Let’s break it down.

Understanding Benford’s Law

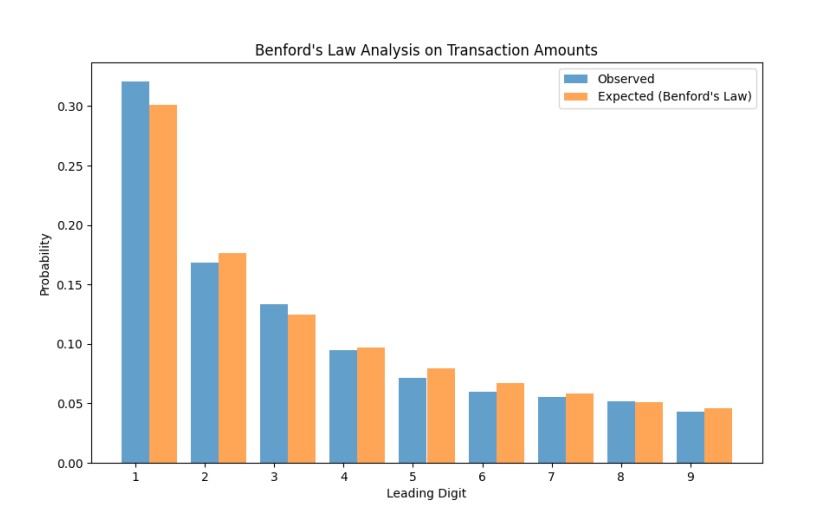

Benford’s Law is a statistical principle that predicts how often digits appear in naturally occurring datasets. It states that in many real-world numerical sets, smaller digits occur more frequently as the first digit than larger ones.

For example, in datasets that follow Benford’s distribution:

- The number 1 appears as the first digit about 30% of the time.

- The number 2 appears around 17.6% of the time.

- The number 9, by contrast, appears only about 4.6% of the time.

This is counterintuitive to many people, who assume that numbers are evenly distributed across datasets. However, in many naturally occurring processes—such as financial transactions, stock prices, or economic data—this skewed distribution holds true.

The reason lies in logarithmic scaling. If a dataset grows exponentially (e.g., a company’s revenue increasing over time), the smaller numbers (such as those starting with 1 or 2) occur more frequently because they take longer to transition into higher digits.

Where Benford’s Law Applies

Benford’s Law tends to hold true in datasets that:

- Span multiple orders of magnitude (e.g., financial transactions, sales data, or tax returns).

- Are unrestricted in how numbers are assigned (e.g., naturally occurring numbers rather than arbitrarily set figures).

- Involve large datasets (as smaller samples may not always reflect the expected distribution).

Because of this, forensic accountants and fraud investigators apply Benford’s Analysis to:

- Expense reports and invoices

- Payroll records

- Procurement and vendor payments

- Tax filings and government contracts

- Corporate financial statements

When fraudsters manipulate numbers, they often fail to replicate the natural distribution predicted by Benford’s Law. Instead, they introduce patterns that stand out, allowing investigators to flag transactions that require deeper examination.

How Benford’s Analysis Uncovers Financial Fraud

Fraudsters are not statisticians. When they forge or manipulate financial data—whether padding expense reports, inflating revenues, or hiding embezzlement—their numbers often deviate from the expected Benford distribution.

Investigators use Benford’s Law as a triage tool—not to prove fraud, but to pinpoint suspicious data that requires further investigation. Here’s how it works in practice:

1. Identifying Anomalies in Expense Reports

Consider a company where an employee is suspected of expense fraud. By analyzing the first digits of expense amounts, investigators can determine whether they follow Benford’s expected frequency.

If the employee is fabricating expenses, they may unconsciously use numbers more evenly distributed (or clustered around familiar values like 50, 100, or 500). A comparison with Benford’s expected pattern can highlight these discrepancies.

2. Detecting Payroll Fraud

Ghost employees—nonexistent workers whose paychecks are funneled to fraudulent accounts—often have salaries or payment amounts that do not conform to Benford’s distribution. If payroll figures show an unexpected frequency of high-value first digits (e.g., an unusual number of salaries starting with 8 or 9), it can indicate artificially inflated payments.

3. Uncovering Procurement Fraud

Procurement fraud is another area where Benford’s Analysis is useful. Fraudulent vendors may submit manipulated invoices, and their transaction amounts may deviate from the expected Benford curve. By running a dataset of vendor payments through Benford’s analysis, investigators can flag those that do not align with expected distributions.

4. Examining Tax Fraud and Government Expenditures

Government agencies and tax authorities have successfully used Benford’s Law to uncover tax fraud. If a company’s reported revenues or deductions do not follow the expected Benford distribution, it raises red flags for potential tax evasion.

In the same way, government expenditure reports that fail Benford’s test may indicate corruption, misallocation of funds, or inflated budgets.

The Benefits of Using Benford’s Law in Investigations

Benford’s Analysis provides several advantages as an investigative tool:

- Rapid Identification of Anomalies – Instead of manually sifting through thousands of transactions, investigators can quickly highlight which areas require deeper scrutiny.

- Objective and Data-Driven – Unlike subjective assessments, Benford’s Law relies on mathematical probability, reducing bias in fraud detection.

- Scalable for Large Data Sets – Whether analyzing corporate finances, government contracts, or tax filings, Benford’s method scales effectively.

- Useful in Court Cases – Benford-based analyses have been successfully used as supporting evidence in legal and regulatory actions.

However, as with any forensic tool, Benford’s Law is not infallible and must be used as part of a broader investigative approach.

Limitations and Misconceptions

While Benford’s Analysis is powerful, it is not a definitive proof of fraud. There are key limitations investigators must recognize:

1. Not All Datasets Follow Benford’s Law

Benford’s Law applies best to datasets that span multiple scales and occur naturally. However, some financial records are structured or regulated, leading to deviations that are not necessarily fraudulent.

For example, invoice amounts that are pre-set at round numbers (e.g., $500, $1,000) may not follow Benford’s expected pattern but still be legitimate.

2. False Positives and False Negatives

- False Positives: Anomalies detected by Benford’s Law do not automatically mean fraud. They serve as red flags but require deeper investigation.

- False Negatives: A clever fraudster who understands Benford’s Law can fabricate numbers to mimic the expected distribution, avoiding detection.

3. Requires Contextual Analysis

Benford’s Analysis is most effective when combined with other investigative techniques, such as:

- Forensic accounting reviews

- AI-driven transaction monitoring

- Witness interviews and behavioral analysis

- Cross-referencing vendor and payroll records

Conclusion: Why You Need an Expert to Apply Benford’s Law

Benford’s Law is a powerful statistical tool that can expose fraudulent financial activities by detecting unnatural patterns in numbers. While not a standalone proof of fraud, it is an effective early-warning system that guides investigators toward suspicious transactions requiring deeper scrutiny.

However, misapplying Benford’s Law can lead to misinterpretation, unnecessary audits, or false accusations. That’s why businesses, government agencies, and legal teams turn to expert investigators who can combine Benford’s insights with real-world forensic expertise.

If your organization suspects embezzlement, procurement fraud, or financial misconduct, don’t rely on DIY techniques. Seek professional forensic analysis to ensure accurate and actionable results.